So, who is in charge of Bitcoin?

This is one of the first questions bitcoin newbies often ask. Naturally, this question pops up as a concern over trust: Who is at the top of the Bitcoin ladder? Is someone pulling strings behind the curtain?

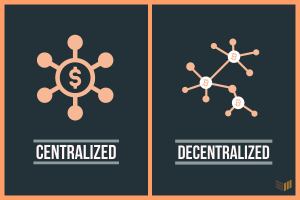

And here’s the simple answer: Bitcoin isn’t controlled by any one country, entity, or person. It’s decentralized, meaning it can’t be corrupted or controlled — and that’s a beautiful thing.

Why do we need decentralization?

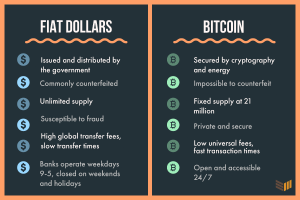

Perhaps the most important aspect of Bitcoin is its decentralization; this is the principal difference that separates Bitcoin from the central banking system we’re currently used to. Inherently, our worldwide banking system is centralized because our money is controlled and distributed by the government. We call this money “fiat” — originating from the latin word meaning: “a determination by authority.”

When you have a centralized fiat currency like the US dollar (the current global reserve currency), you are coerced into a financial system that can change the rules at any time. You are subjected to the big banking system that charges you overdraft fees, requires minimum balances, and lends your money out to other people only to pay you less than 1% in annual interest.

And while big banks in the United States have healthy competition and therefore have incentives to offer better, freer services to consumers, many countries around the world don’t offer this privilege. In fact, many banks overseas actually charge their consumers to keep their money in the bank.

What is this highway robbery? You might as well keep all your cash under your mattress.

As much as we like to joke about this, the use of physical, insecure piggy banks are a reality for over a billion people around the world who remain unbanked.

Financial services create expensive barriers like fees, minimums, and identification requirements that don’t allow people to participate fairly in it. Additionally, not everyone has access to a competently secured and insured central banking system; they must participate in the one handed to them by their government, no matter how unstable or corrupt it is.

What fixes this?

There’s a saying in the Bitcoin community: Bitcoin fixes this.

Because nobody is in charge of Bitcoin, Bitcoin works for everyone. Rather than having someone at the top, the Bitcoin Network is based on the consensus of everyone who participates in it.

It doesn’t matter what country you’re in or how controlling your government is — your wealth is secured by the bitcoin blockchain all the same, and no one has the authority or power to change this. While it is technically possible for bitcoin to be “hacked” or controlled, I’ll go over why this won’t ever happen in a later email.

Bitcoin is an opportunity for the unbanked to store and grow their wealth in a secured way, where nobody can be locked out or denied — and it doesn’t care about your credit score.

Decentralization is privacy

In traditional banking, you are subjected to approvals based on credit scores and government identification. This makes everyone susceptible to fraud; if someone steals your identity, they can open up credit cards, generate debt in your name, and destroy your credit score.

With Bitcoin, your participation is not dependent on your identity. Anyone and everyone can participate anonymously, as names and personal data are not connected to transactions on the Bitcoin blockchain.

Although most cryptocurrency exchanges (places where you can buy bitcoin) require a Know Your Customer (KYC) process that requires you to verify your identity with a selfie and photo ID, once you take your bitcoin off of the exchange and into your own self-custodial wallets, all transactions from that point forward are pseudonymous.

Later on in this series, I’ll show you how you can secure your bitcoin by taking it off of exchanges and into your own self-custody solutions.

Ultimately, nobody controls Bitcoin at the top—but Bitcoin allows you to be your own bank and fully control your own wealth without the oversight of anyone else.