What is money anyway?

Formally defined, money is something that is widely accepted for purchasing goods and services, or repaying debts and taxes. You might think that this is limited to paper bills and minted coins, but the reality is that anything can be money, so long as it fulfills these fundamental use cases: a unit of account, a medium of exchange, and a store of value.

Looking back in history, the items that our ancient ancestors once traded and bartered with were considered their forms of money. This included everything from shells and animals to silver and gold. In modern times, we see a reflection of this in places where government money is of little value, such as in prisons, where cigarettes and instant ramen are well-known units of account.

From the 14th century all the way to the 20th century, cowrie shells were used as currency to barter and trade across Africa and Asia. Durable, divisible, identifiable, and scarce, cowries were the perfect pre-coin era natural currency. Other items like glass beads, stones, and salt were used throughout different cultures as well. Imagine: you might be skipping rocks on the ocean today that were once regarded like the dollars in your bank account. Those ancient currencies are all worthless today because they eventually fell victim to the killer of value: hyperinflation.

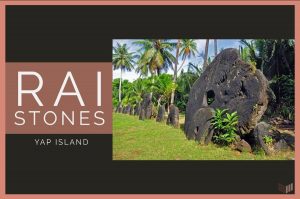

Learning from the Rai Stones on Yap Island

One of the most interesting ancient monetary systems was the use of Rai stones on the Island of Yap (part of Micronesia).

The Yapese people used large, heavy stones—up to 12 feet in diameter— with a hole in the center as their currency because of their rarity and difficulty to procure from the neighboring islands. To ship the Rai stones to Yap via rafts and canoes, often hundreds of people were needed, meaning it was nearly impossible for anyone to quickly inflate the supply.

For centuries, the Rai stones were used as sound money. Placed in a central location where everyone had access, the Rai stones were only exchanged in recognition of ownership rather than possession (since they were impossible to carry around).

This monetary system worked well for centuries. But in 1871, an Irish American by the name of David O’Keefe washed ashore and saw a huge business opportunity in producing coconut oil procured by the island’s abundant coconuts. He realized that the Yapese people had no interest in foreign money, so he set sail to the nearby island Palau where he used modern tools and explosives to procure several large Rai stones to take back to Yap.

However, the value in the Rai stones was calculated based on a complex formula of size, history, quality, and the number of lives lost due to the labor of procuring these stones. Simply put, they had value because they were difficult to obtain; O’Keefe’s Rai stones were obtained easily, negligent of tradition, so many villagers were not keen on accepting the stones as valid. An ancient remnant of counterfeit currency, if you will.

Unfortunately, other Yapese did not understand the concepts of scarcity and sound money, so they gladly accepted these false stones, which eventually led to the demise of the Rai as the sound currency it once was.

Modern Hyperinflation

Taking a look at modern examples of exorbitant money printing in countries like Venezuela and Zimbabwe, we see a similar modern hyper-inflationary story playing out. If we are to learn from history, we must realize workable solutions to the vulnerabilities that previous currencies have fallen victim to. But rather than worrying so much about things we can’t change in fiat, we can look towards real solutions.

Before, we could only dream of such impossible things. Now, we have Bitcoin.

Bitcoin is a new form of money that solves the issues surrounding scarcity and currency debasement. Tomorrow, I’ll go over bitcoin’s fixed supply cap and the case for why bitcoin will never lose its purchasing power the way every other money before it has.