3 Catalysts pushing crypto forward in 2024

Trends that have already been driven crypto in 2024

2024 is starting where 2023 left off. Momentum keeps driving crypto forward, with certain pockets benefitting in particular. Let’s dive into these key narratives and what 2024 may have in store for them.

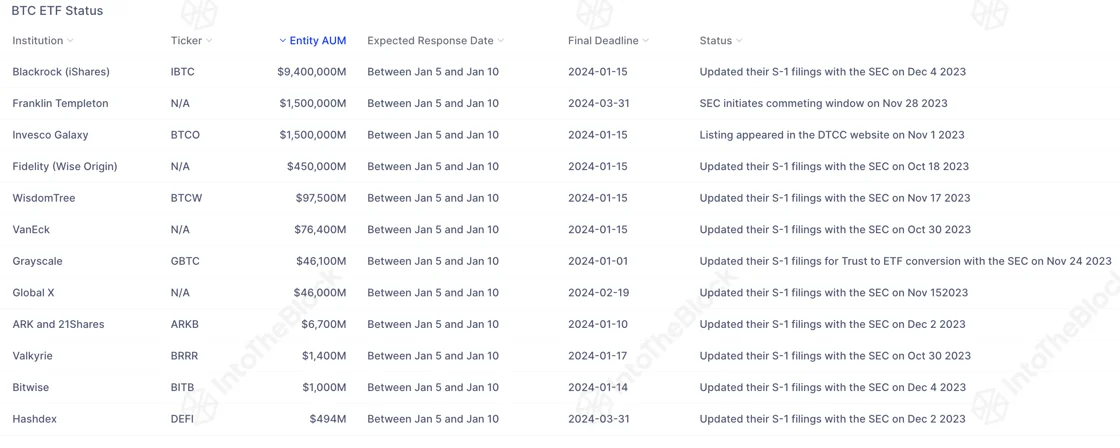

1- Bitcoin ETF Launch – More than 10 years after the first Bitcoin ETF spot application, it appears we are primed for it to launch this month. Multiple applications from some of the largest asset managers are expected to receive a response regarding their approval as soon as today, January 5.

Source: IntoTheBlock’s Bitcoin ETF Perspectives

Will the Bitcoin ETF Finally be Approved? The answer to this question can vary significantly based on the person answering

- In a Bitwise report surveying financial advisors in Q4 showed that only 39% of advisors expected a spot Bitcoin ETF to launch in 2024

- On the other hand, Bloomberg ETF analysts have consistently been point at 90% odds of approval for the ETF, while a senior crypto reporter at TechCrunch pointed to the approval for multiple firms, “expecting something tomorrow” (January 5)

- While traditional finance companies were still skeptical of the Bitcoin ETF approval, people familiar with the matter suggest the approval to be imminent

Is an Approval Priced In? Given the seemingly high odds of approval, is the market move from the ETF already factored in by market participants?

- Following a hypothetical approval announcement, a poll from crypto anon Hsaka suggests that 50% of respondents believe prices will be at least 5% higher within 48 hours, with just 22% voting it would drop by 5% and the remainder voting for it to remain rangebound. Though not extremely bullish, it does show a positive consensus, opening things up for a potential downside surprise

- In a recent interview, Jim Bianco also noted that traders have been front-running the potential inflows from an ETF by investing into Bitcoin proxies such as Coinbase’s stock, MicroStrategy and GBTC, all which outperformed Bitcoin in the last quarter

What’s Next? The next week should be interesting as the final decisions are announced

If the ETF is approved, then the market’s attention is likely to shift to whether it’s an initial “sell the news” event first

The next parameter to watch will be just how much volume these ETFs are able to attract within the first days of trading. If these disappoint, there is potential risk for the market, which has been overly optimistic

Regardless of the outcome, the Bitcoin ETFs are likely to continue being a major catalyst affecting crypto in Q1 of 2024

2- Ethereum’s Dencun Upgrade Impact on L2s – After being delayed a few months, Ethereum is on track to deploy its next major upgrade in late Q1 or early Q2. EIP-4844, also known as protodank sharding, is one of the most anticipated changes coming, bringing down transaction costs on layer 2s by 10x or more

Source: IntoTheBlock’s Arbitrum Incentives Program dashboard

Accelerating L2 Growth – The main layer 2s have been seeing sharp growth in prices and key metrics

- Optimism’s OP token is up 180% over the last 90 days, while Arbitrum’s ARB has increased by 130% within the same period

- As we discussed in 2023 On-Chain, the number of transactions on these Ethereum L2s has climbed by more than 90x in the last two years

- The reduction in transaction costs is expected to attract further economic activity into L2s due to reduced friction

Arbitrum’s Moment – Although OP has outperformed over the last three months, Arbitrum metrics are showing signs of progress in 2024

- The total amount of trading volume on Arbitrum surpassed that of Ethereum Mainnet on January 4 for the first time, per DeFi Llama data

- Arbitrum’s incentive program has increased TVL on the L2 by nearly 50%, as shown in ITB’s dashboard

Overall, Ethereum’s transition to L2s has been in motion already, and is set to accelerate following the implementation of the Dencun upgrade. As such, the L2 ecosystem and their tokens are a main area of focus going into 2024.

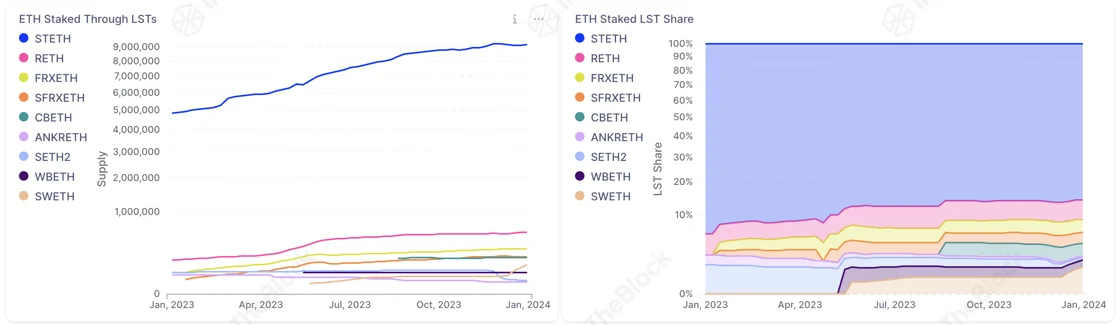

3- Restaking & Liquid Staking – In terms of new products, EigenLayer’s launch is set to be one of the most anticipated releases of 2024. EigenLayer is an infrastructure layer that will enable “restaking”, or using Ethereum’s existing staked funds in order to validate additional features for applications building on top of it. Its launch is set to bring forth new applications, while benefitting the existing liquid staking protocols.

Source: IntoTheBlock’s Ethereum Liquid Staking Perspectives

Impact of Restaking on LSTs – Restaking on EigenlLayer will provide higher yields on top of the existing staking rate

- Users of EigenLayer can deposit liquid staking tokens, such as Lido’s stETH, and earn extra yield from the actively validated services (AVSs) they choose to validate

- Prior to their main launch, EigenLayer has already attracted over $1B in deposits, through their points program

- Over 70% of deposits into EigenLayer have come through liquid staking, pointing to large role these are likely to play as the launch approaches

- Building both restaking and data availability services, EigenLayer is also likely to offer one of the largest airdrops in crypto history, as evidenced by the funds they have managed to attract just off of their points system

Just a week into the year, chatter around restaking has grown as EigenLayer reached its cap of the amount of ETH staked into the product. Liquid staking projects governance tokens such as LDO have also been favored by the market, appreciating by over 10% year to date. Ultimately, the launch of this new primitive is expected to be one of the key narratives shaping crypto throughout the year.