Key Insights

- Decentralized Wireless (DeWi) aims to revolutionize the way communication networks are built, operated, and owned by incentivizing operators to deploy and maintain telecom hardware in exchange for token rewards.

- DeWi networks achieve superior unit economics compared to legacy providers due to the reduction in CapEx and OpEx; DeWi also eliminates spectrum licensing costs and flat rate charges to end users.

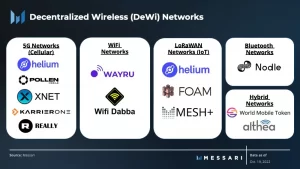

- As of October 2022, there are more than 14 DeWi networks (including cellular, WiFi, IoT, Bluetooth, and hybrid networks) supported by an ecosystem of enterprise deployers, service providers, and marketplaces.

- Among the most immediate opportunities for DeWi is the 5G cellular market, with Helium and Pollen Mobile leading the charge.

Technological advances in hardware and telecom infrastructure over the past few decades have created a hyperconnected world, where 2.5 quintillion bytes of data are created every day. Thanks to mobile phones, today, 66% of the world uses the internet as opposed to 7% in 2000. As internet connectivity and access around the world increase, the amount of data created will only continue to increase.

The rise of new technologies – autonomous vehicles, the Internet-of-Things (devices with sensors connected to the internet), smart cities, and extended-reality environments – has led to an increase in global demand for higher bandwidth and lower latency networks. However, traditional wireless (TradWi) network operators are unable to keep up with this increased demand.

A new generation of telecom cowboys is pioneering the decentralized wireless (DeWi) movement. These cowboys offer an alternative method to deploying and operating networks using cryptoeconomic protocols. Next-generation wireless networks can be bootstrapped using the coordinating abilities of blockchain technology. Instead of a single, centralized telecom player building out a wireless network, millions of sovereign individuals can be aligned to deploy and operate wireless infrastructure in a trustless, permissionless, and programmatic manner.

Background on the Telecom Industry

Deploying wireless networks has historically required the work of large corporations due to considerable capital expenditures (CapEx) and operational expenses (OpEx), complicated logistics, and regulatory hurdles. This resulted in a handful of companies controlling the pricing structure and conditions for the end user, effectively eliminating a free market. In the US, just three companies – AT&T, Verizon, and T-Mobile – make up 98.9% of the wireless market. In Q2’22, these companies cumulatively generated $270 billion of annualized revenue.

Traditionally, roughly every 10 years, telecom companies (telcos) deploy new wireless networks. This process involves:

- Raising tens of billions of dollars in debt to finance CapEx and OpEx

- Buying spectrum licenses from the government

- Contracting manufacturers to build proprietary hardware

- Finding property owners willing to host towers and radios

- Mobilizing thousands of field technicians to install and maintain complex equipment

Disrupting a Sleepy Trillion-Dollar Industry

Today’s digital age has resulted in a $1.7 trillion global telecom market that is expected to grow at a 5.4% compound annual growth rate (CAGR). By 2028, the global telecom market is expected to reach $2.7 trillion. However, the lack of competition, enormous customer dissatisfaction, and the constant demand for higher bandwidth connectivity at increased speeds has set the industry up for disruption.

The traditional top-down model telcos use to build networks is unsuitable for building next-generation wireless networks. New wireless networks – such as 5G – require significantly more radios and antennas than older generation networks, which is not economically feasible for telcos. Additionally, the legacy telco model has traditionally been optimized to cover densely populated areas, leaving many less populated, rural areas without adequate coverage. If one lives in a region without proper coverage, there isn’t much that can be done if relying on TradWi telcos.

With DeWi’s open access deployment model, DeWi networks can add wireless density where it’s not financially feasible for TradWi providers. DeWi also empowers individuals to improve their connectivity. For example, the owner of a restaurant with historically bad connectivity could deploy their own DeWi equipment, solving their connectivity problem for themselves and their customers. While it’s highly unlikely that DeWi completely replaces TradWi networks, the two can coexist with one another and have a symbiotic relationship.

Why DeWi Now?

During the past few years, the telco industry has undergone three major shifts that have positioned DeWi adoption to happen now: eSIMs going mainstream, the opening of wireless spectrums, and the advancement of blockchain technology and wireless hardware.

eSIM Going Mainstream

Last month, Apple released the iPhone 14 with one major difference: there is no longer a physical SIM card slot. The latest iPhone embraces the digital alternative known as an eSIM, which can be configured by scanning a QR code. This is a significant development for DeWi cellular networks because it reduces carrier switching costs to near-zero. Additionally, since the iPhone 14 has 6 eSIM slots, users can install a DeWi eSIM in addition to their existing traditional carrier’s eSIM, and utilize both cellular networks.

In 2021, it was estimated that 350 million eSIM-capable devices were shipped globally. By the end of this decade, it is projected that there will be around 14 billion eSIM-capable devices. Apple’s recent decision to go the eSIM route will likely accelerate this trend.

Opening of Wireless Spectrums

Spectrum refers to the radio frequencies that wireless signals travel over. In the U.S., spectrum is overseen by the Federal Communications Commission (FCC) and is categorized into two types: licensed and unlicensed.

Licensed spectrum is auctioned off by the FCC to the highest bidder, meaning it’s bought for exclusive use by specific network operators. Over the lifetime of these auctions, $250+ billion has been paid to the U.S. Treasury from spectrum license sales. This is an expense that telcos have passed down to consumers.

Unlicensed spectrums on the other hand are available for anyone to use. WiFi, Bluetooth, and LoRaWAN are unlicensed spectrums.

The Citizens Broadband Radio Service (CBRS) band was previously only available for use by the U.S. Navy. However, in 2020, the FCC authorized public use of the CBRS band. This is significant because it allows new entrants to deploy 5G networks without having to acquire expensive spectrum licenses.

Back in 1985, the FCC fundamentally changed the way humans communicate and operate by opening up the WiFi spectrum band for public use. It allowed anyone to buy a WiFi router and create their own wireless connection. It’s possible that CBRS can revolutionize cellular networks in the same way that WiFi did for internet connectivity.

Advancement in Blockchain Technology and Hardware

Humans are incentive-driven. However, before blockchains, it was extremely difficult to facilitate large-scale coordination of individuals globally. Now, with cryptoeconomic protocols, individuals can be incentivized to work toward a common goal in a trustless and programmatic way.

Additionally, advancements in wireless technology have made hardware more affordable and accessible. Plug-and-play hardware makes it easy for the average person to participate in deploying DeWi hardware.

The DeWi Movement

A new era of innovation has emerged that leverages token incentives for the development of physical infrastructure networks in the real world. This category has been referred to as Proof of Physical Work (PoPW), Token Incentivized Physical Infrastructure Networks (TIPIN), or EdgeFi.

Escape Velocity, a fund focused on investing in decentralized infrastructure networks, has broken down the physical infrastructure space into the following sectors: decentralized wireless (DeWi) networks, sensor networks, server networks, and energy networks. Despite the potential of these networks, the DeWi sector has attracted the earliest attention.

DeWi aims to revolutionize the way communication networks are built, operated, and owned by incentivizing operators to deploy and maintain telecom hardware in exchange for token rewards. By distributing the costs associated with building and maintaining a network to supply-side participants, a more cost-effective method of bootstrapping a network is uncovered.

DeWi’s Origin Story

In July 2019, Helium pioneered the DeWi movement with its LoRaWAN network designed to power the Internet of Things (IoT). Through the success of its LoRaWAN network, which has grown from 15,000 hotspots in January 2021 to over 900,000 hotspots today, Helium has shown that token incentives can be used to build out distributed infrastructure networks. Helium’s LoRaWAN network stands as the largest IoT network in the world, operating in over 182 countries.

More recently, Nova Labs – the company behind Helium – announced its vision to transform Helium into a decentralized platform where any type of telecom network can be deployed. This strategic shift turned Helium into a network of networks, where the same process that enabled the LoRaWAN network to rapidly scale could be replicated onto numerous other network types including 5G, WiFi, VPN, and CDN.

The DeWi Sector

With the success of Helium’s LoRaWAN network, many projects were inspired to launch new DeWi networks using a similar model to Helium’s. Today, more than 14 DeWi networks exist, including cellular, WiFi, LoRaWAN, Bluetooth, and hybrid networks.

- 5G Networks (Cellular): The two prominent players in this category are the Helium 5G and Pollen Mobile networks that leverage the recently deregulated CBRS spectrum. The cellular market opportunity is the largest compared to other network market sizes.

- WiFi Networks: DeWi WiFi networks aim to create a globally shared WiFi network that anyone can connect to at a low cost. WayRu and WiFi Dabba are two early-stage projects building in this category.

- LoRaWAN Networks (IoT): LoRaWAN (Long Range Wide Area Network) is a long-range and low-power wireless communication protocol. It is suitable for transmitting small data packets – like sensor data – over long distances, which has made it the go-to network for IoT devices. Besides Helium, Foam and Mesh+ are building in this category.

- Bluetooth Networks: Bluetooth Low Energy powered networks are suitable for low-power and low-range use cases. Nodle is a Bluetooth mesh network that leverages smartphones and Bluetooth Low Energy routers to connect IoT devices to the internet.

- Hybrid Networks: Hybrid networks combine different wireless technologies into a single solution to provide decentralized internet connectivity. Althea and World Mobile Token are two examples of this.

How the Model Works

DeWi networks utilize a novel token distribution mechanism that rewards participants for completing verifiable work in the real world. This incentive system is responsible for the economic flywheel that allows a network to be bootstrapped without a centralized entity.

The economic flywheel begins by offering users a reward to acquire and deploy network hardware:

- Hardware operators are incentivized with inflationary token rewards for purchasing and deploying a hotspot or radio and maintaining it. These rewards act as a subsidy for operators, allowing them to immediately begin earning a return on their hardware investment. The rewards typically support the participants in building the network before the network begins generating sustainable fees from demand-side usage.

- As the wireless network grows, more operators and product builders are attracted to the network. Additionally, DeWi’s improved unit economics (compared to TradWi) and the token subsidy to hardware operators allow the protocol to offer cheaper data transfer rates, helping attract end users.

- Once the network’s coverage grows large enough to warrant end users to begin paying to transmit data through the network, revenue for hardware operators increases significantly. In addition to the network’s subsidy, operators earn fees based on the amount of data flowing through their hardware. This economic mechanism creates a feedback loop that ends up attracting more hardware operators and investors.

- Value is typically captured through a burn-and-mint equilibrium (BME) token model or a work-token model. While a network’s utility increases as supply is either burned via a BME model or staked by service providers via a work-token model, the token price should theoretically increase. The rising token price flows back into attracting more hardware operators, creating a ۀcycle.

The network effect created by the DeWi economic flywheel essentially solves the cold start problem. Using rewards, a protocol can motivate participants to bootstrap the supply-side of a network to the point where its coverage is large enough for end-user use. This allows protocols to build up the initial momentum needed to gain adoption and compete with centralized telcos. In exchange for building out the supply side of a network, operators receive ownership stakes in the network, which motivates them to see it succeed.

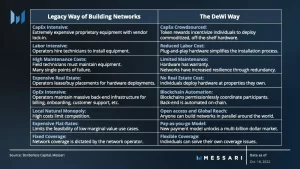

Legacy Network Deployment Model vs. DeWi’s Model

The DeWi method of deploying networks improves significantly upon the legacy model. The above chart builds ontop of Borderless Capital’s EdgFi research.

The largest advantage DeWi has over TradWi’s network deployment is the reduction in CapEx and OpEx. Building networks the legacy way requires a centralized entity to spend tens of billions of dollars to acquire spectrum licenses, purchase proprietary hardware with vendor lock-in, lease land for deployments, pay thousands of field technicians to install and maintain equipment, and maintain a massive back-end infrastructure for planning, onboarding, billing, and customer support. And the costs are ultimately passed onto the consumer.

Using the DeWi method, CapEx and OpEx are crowdsourced to individual operators participating in the network. Operators purchase commoditized, off-the-shelf hardware that can be installed with little effort. For example, setting up a LoRaWAN hotspot is as easy as plugging ethernet and power cables into the device, which takes less than five minutes. On the other hand, cellular radios are a bit more complex for the average person, requiring additional time and technical knowledge to install.

For retail deployments, DeWi operators are able to place their hardware on properties they own, removing any real estate costs. For commercial deployments, operators will have to pay a third-party landlord. However, DeWi allows operators to enter automated revenue-sharing agreements based on the revenue generated by each hardware device. This is in contrast to TradWi deployments where operators have to pay a fixed cost to landlords. The DeWi revenue-sharing model is not only more efficient, but allows for real-estate owners to verify the earnings of the hardware on their properties, and therefore their revenue cut.

To summarize, DeWi is able to achieve superior unit economics to TradWi through the reduction of CapEx and OpEx and the elimination of spectrum costs and flat rate charges to end-users.

State of the DeWi Ecosystem

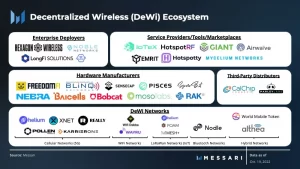

Hardware Manufacturers

Originally, Nova Labs was the first manufacturer of LoRaWAN miners able to bootstrap the Helium network. However, Nova Labs’ goal was never to get into the hardware business. Eventually, in January 2021, Helium passed HIP 19, which allowed the Helium community to approve third-party manufacturers to produce and sell hardware through the protocol’s governance process. This not only further decentralized the network, but contributed to its rapid growth.

Today, there are over 65 Helium hardware manufacturers with a few of the top players highlighted in the above ecosystem map. Many of the Helium hardware manufacturers have expanded to building hardware for other DeWi protocols such as Pollen Mobile. Due to the open nature of the ecosystem, any hardware manufacturer can get involved, bringing healthy competition to the market.

Enterprise Deployers

Enterprise deployers are centralized entities that operate on top of DeWi networks, acting as partners with the network to professionally deploy and manage hardware at scale. These entities provide expertise when it comes to procurement, installation, optimization, and management of hardware. Additionally, these companies leverage their enterprise partners, including real estate owners and hardware manufacturers, to deploy hardware at scale.

Hexagon Wireless is the one of the largest protocol-agnostic enterprise deployers currently deploying hardware for the Helium and Pollen Mobile networks. With the goal of accelerating the DeWi movement, Hexagon eventually plans on investing in DeWi applications and tooling in verticals such as financial services, fleet management software, and wireless coverage as a service. Other enterprise deployers include Noble Networks and LongFi Solutions.

Service Providers, Tools, and Marketplaces

An ecosystem of tools, service providers, and marketplaces have begun to emerge. Tools such as Hotspotty and Airwaive help act as coordination tools for the DeWi community. Hotspotty assists with location optimization, hardware monitoring and management, and payment management. Airwaive is a marketplace that connects network operators with residential or commercial building owners who are willing to host DeWi hardware.

5G: The DeWi Honeypot

Since 2017, global mobile data traffic has increased by 570%. Today, 59% of the world’s web traffic originates from mobile devices. Hexagon Wireless states that the cellular opportunity is more lucrative than LoRaWAN is or likely ever will be. They believe the market opportunity for cellular networks is estimated to be 88x larger than IoT networks. 5G already has enormous demand. Therefore, the most immediate opportunity for DeWi is the cellular market.

Until early 2022, Helium was the only protocol pursuing the 5G market. As of today, four other protocols have entered the race to compete over the enormous opportunity: Pollen Mobile, XNET, Karrier, and REALLY. A future report will explore DeWi 5G networks in depth and analyze the differences between the projects.

Next-Generation Wireless Networks

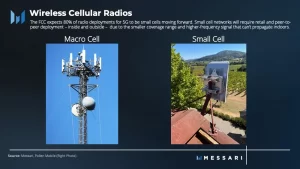

Next-generation wireless networks, such as 5G, require an alternative to the traditional deployment model. Historically, macro cell radios, installed on large towers or masts, were used to provide large geographic area coverage for cellular networks. The problem with macro cells is that the coverage they provide is low-frequency and 5G networks require higher-frequency bands – unlike older-generation cellular networks – for increased bandwidth.

Instead, small cell radios are needed to enable future 5G networks. Small cells are low-powered radios – roughly the size of a pizza box – which provide high-frequency coverage. The small size of the hardware means that it can be installed in more convenient areas such as the roof of a house, a light pole, or on the side of a building.

However, unlike macro cells, small cell coverage only extends roughly 100 yards to just over a mile, and the high-frequency signal has difficulty propagating through buildings. This means that it will take significantly more small cells – indoors and outdoors – in close proximity to one another to achieve equitable coverage to macro cells.

The FCC expects 80% of deployments for 5G to be small cells moving forward. The issue, or opportunity, at hand is that traditional telcos are ill-equipped to build out these small-cell networks since their deployment model is optimized to provide overall macro coverage rather than last-mile or indoor coverage. The CapEx and extraordinary logistical requirements to build small cell networks nationwide just don’t make economic sense for TradWi operators. Small cell networks will require retail and peer-to-peer deployments. DeWi can help with this.

DeWi offers an economically more efficient solution to building out 5G networks. Rather than replacing TradWi, DeWi may be able to work hand-in-hand with it. DeWi allows users around the world to build networks in parallel, which is much faster than the centralized method. Participants with specific knowledge about their jurisdiction can focus on deploying infrastructure that meets the needs of their local market. Together with TradWi’s macro coverage and DeWi’s small cell coverage, 5G could become more accessible to people around the world.

The Future of DeWi Cellular Networks

There are three different ways DeWi cellular networks can position themselves: as a neutral host, cryptocarrier, and private network.

The neutral host model allows multiple mobile network operators (MNOs) to use DeWi network-owned infrastructure. This could entail data offload partnerships where MNOs roam onto DeWi cellular networks when a user is in an area without coverage from their carrier. Additionally, MNOs could pay to offload data when their networks are congested, avoiding service degradation. It’s likely that DeWi small cell networks will be used to densify traditional MNO’s macro networks.

The alternative to the neutral host model is the cryptocarrier route. Nova Labs defines a cryptocarrier as, “an innovative mobile carrier model that leverages people-built coverage and cryptoeconomics to reduce costs and increase benefits for subscribers.” Last month, Nova Labs unveiled their own cryptocarrier, Helium Mobile. Notably, cryptocarriers are similar to a mobile virtual network operator or an MVNO – a service provider who doesn’t operate their own infrastructure.

Nova Labs’ cryptocarrier combines Helium’s 5G network with T-Mobile’s network. When Helium Mobile subscribers are in an area without DeWi coverage, the cryptocarrier switches over to T-Mobile’s network.

The last option is a private network. Pollen Mobile began as an in-house connectivity solution for Pronto – an off-road autonomous vehicle technology company. Pronto’s vehicles needed reliable internet connectivity in remote locations, so the team built their own private cellular network, leading to the spinout and formation of Pollen.

Private cellular networks will become increasingly popular due to their ability to offer enterprises flexible coverage with lower latency and higher bandwidth connection. It also offers end users improved security and privacy. Although the Private 5G network market size was valued at $1.4 billion in 2021, it is expected to reach $34 billion in 2030, a 49% CAGR.

The biggest opportunity for DeWi right now appears to be the neutral host model. GigSky and Dish have already announced they will be leveraging Helium’s 5G network to offload data. This means their customers will seamlessly roam onto Helium’s CBRS network wherever it’s available. While Pollen Mobile’s original use case was as a private network, the company has hinted at pursuing a neutral host model for data offloading. Furthermore, XNET, a project launched by previous traditional telco executives, has announced their intention to pursue the neutral host route.

Final Thoughts

Although the DeWi sector is still nascent, the potential for it to revolutionize the telecom industry is clear. The rapidly increasing number of protocols trying to claim a share of the DeWi cellular market shows the significant opportunity that lies ahead. Additionally, there are a number of former traditional telco executives behind many of the newer DeWi projects, further strengthening DeWi’s legitimacy.

In line with recent developments, DeWi cellular networks are not going to replace traditional MNOs, but will likely coexist with them, at least in the short term.