Yesterday, we went over how Proof of Work functions in confirming transactions and creating new bitcoin. Today, I’ll paint a more general picture of what mining looks like and how new bitcoin is distributed over time.

What Does Mining Look Like?

Mining in the industrial age vs mining in the digital age:

Bitcoin mining is unlike any other kind of mining. It’s simple to set up, runs 24/7, and violates no human rights or labor laws.

Here’s how it works. Basically, a bunch of specialized computers (ASICs: application-specific integrated circuits) are set up to mine bitcoin somewhere where electricity is cheap (since miners require a lot of computing power). As stated yesterday, miners can work together in pools to split profits and increase their odds of winning a new block.

With each new Bitcoin block that is mined, batches of transactions are recorded and confirmed to the blockchain. By confirming transactions and computing a winning hash, miners are rewarded with newly minted bitcoin. However, this block reward won’t last forever, since the supply of bitcoin is capped.

The Halving: A Four Year Cycle

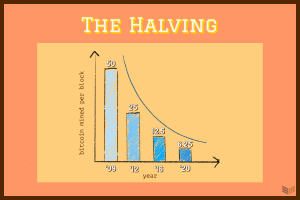

At the Bitcoin network’s genesis, 50 bitcoin were mined in each block.

For every 210,000 blocks — approximately every four years — the number of new bitcoin mined per block is cut in half. As of 2021, only 6.25 new bitcoin are mined in each block. Some time in 2024, the block reward will be cut to 3.125 bitcoin.

This is the Bitcoin halving schedule:

When the supply of new bitcoin introduced is cut in half, its rate of inflation is effectively cut in half as well. This brings us back to our basic concepts of supply and demand.

Over time, as more people are introduced to the Bitcoin network and start participating in it, demand rises. At the same time, supply growth shrinks because of the halvings. As a result, the price of bitcoin is pushed higher and higher over every four-year cycle.

Another reason for miners to receive fewer bitcoin rewards each halving cycle is with the anticipation of the network growth. As more users enter the Bitcoin network, more transactions take place. Each block can only hold so many transactions, so users must essentially “bid” on a spot for their transaction to be confirmed.

For miners, this means that they receive high fees from users as incentives to include their transaction in the next block.

For users, this means increasingly higher fees or slower transaction times.

This is an issue that has been thought about long and hard, and new developments are still in their early stages. But, there are viable solutions, such as the Lightning Network. As you continue to learn about Bitcoin over the next few weeks, I’ll go more deeply into solutions for scaling transactions and how we can continue to develop the network.

Tomorrow, we’ll explore an important part of the Bitcoin network that you can easily participate in yourself: full nodes.