21 Days of Bitcoin DAY 21: Hyperbitcoinization – Life Under the Bitcoin Standard

Hyperbitcoinization - Life Under the Bitcoin Standard

There’s one important question left to be answered.

When we talk about how fiat currencies are “unstable,” this simply means that there is room for instability within the structural design of fiat currencies — that governments can be corrupted and make poor fiscal decisions such as printing exorbitant amounts of money. But there remains a concern for instability in bitcoin, in that the price of bitcoin fluctuates too much for it to be used as a day-to-day currency.

There is a difference between the instabilities here — Bitcoin is secure, fiat is insecure; bitcoin is volatile, fiat is relatively stable in price(at least in powerful nation-states). In order to actually use bitcoin the way we currently use fiat one day, it needs to be stable. So, the question remains: How can we ever enforce a bitcoin standard if the price in terms of fiat dollars fluctuates so much?

Will Bitcoin Replace Fiat?

There are a few hypothetical scenarios that could play out. Some people think fiat will never disappear, while others think that bitcoin will completely overturn the existing financial system. Whatever happens, one thing remains true: Bitcoin is here to stay and will continue to play an increasingly prevalent role in our global financial system.

Realistically, bitcoin will not do a complete overhaul of fiat. However, anything is possible, and it’s a scenario that hasn’t played out before which is why it’s so hard to imagine. If bitcoin were to replace fiat, it would likely require the good-will of worldwide governments to concede to a decentralized currency. Knowing anything about any of our governments, it’s a highly unlikely scenario.

Instead, the path to global adoption will look more like individuals choosing self-sovereign stores of wealth. Keep in mind that because Bitcoin is permissionless, taking the right privacy measures means you can use and hold bitcoin even where outlawed.

Most likely, we will continue treating bitcoin as a store of wealth — an asset like real estate or stocks — that we can utilize in conjunction with the legacy lending system. By storing a portion of bitcoin as collateral, people can borrow fiat money to pay for day-to-day living expenses. There are a few lenders in some countries who have released this capability already.

CBDCs: Central Bank Digital Currencies

Many politicians have called for the implementation of CBDCs — a centralized digital currency — that would allow governments to retain their central authorities over monetary policies. This, if implemented, may come with less privacy than the cash system we still use today.

They foolishly think that this will kill the cryptocurrency industry as a whole. However, because so many people are afraid of CBDCs like the digital yuan potentially exercising privacy and personal security violations, this may well push bitcoin adoption forward as people seek the only truly self-sovereign money solution out there.

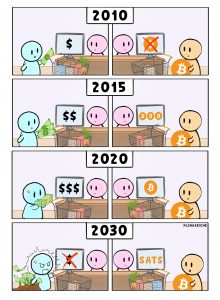

The Bitcoin Standard

When we think about the volatility of bitcoin, we think about it in terms of dollars, or whichever other fiat currency is native to us. But if we were to truly adopt a bitcoin standard — without fiat in the picture — then…what exactly are we comparing bitcoin’s price to? Is one bitcoin today not still one bitcoin tomorrow? Are 50 sats not still 50 sats?

As technology advances, our consumer goods naturally become cheaper — deflationary, if you will. As central governments strive to manipulate markets and prevent deflation at all costs, I implore you to think about the true alternative that bitcoin allows. If our current system is so broken, why are we still trying to break it? For more reading on this topic, I encourage you to read “The Price of Tomorrow”, **by Jeff Booth.

Over the last three weeks, we’ve taken down our fiat walls and opened the door to true sound money. This is just the beginning of your Bitcoin journey, and you have so much left to learn.

Bitcoin is our newfound grace — and all we know since our fiat days is, everything has changed.

Wait, don’t go! It doesn’t have to be over quite yet…. Continue the conversation on Twitter with #21DaysofBitcoin