Look at the chart of the native token for nearly every Decentralized Exchange (DEX), and you’ll see a familiar pattern: pump followed by, wait for it, dump.

The household name DEXs like Uniswap, Sushi, and even TraderJoe are alive and well despite the lackluster price action of their tokens, but many other DEXs have faded into oblivion. Exchanges you’ve probably never heard of like Smoothy Finance and LuaSwap managed to attract short-lived liquidity, but as their generous incentives for liquidity providers dried up, mercenary LPs dumped the native tokens they got for free and, critically, they proceeded to move their liquidity back to where the volume is (ie. the household names). This was a double blow for the DEXs they sucked dry; when both Total Value Locked (TVL) and token price tank, the result is a death spiral.

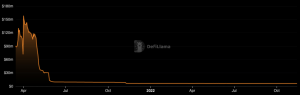

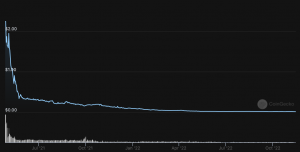

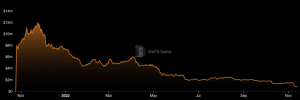

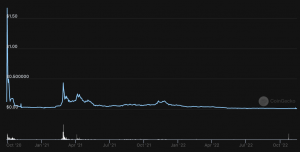

Observe the TVL and price action for the above-mentioned Smoothy Finance (SMTY) and LuaSwap (LUA):

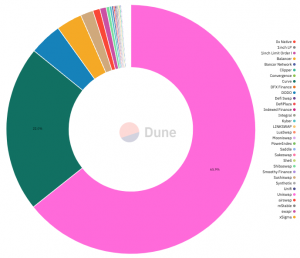

The DEX game, it seems, is winner take most:

The DEX space is dominated by a few giants like Uniswap and Curve, but littered with the remains of many short-lived contenders like Smoothy Finance and LuaSwap. Note that Uniswap (pink) and Curve (green) account for over 75% of DEX volume.

Why then, would Bitcoin.com launch the Verse DEX? How can Bitcoin.com’s DEX succeed where so many others have failed, and how can it compete against already well-established DEXs?

To answer this question, we’ll first explain why Bitcoin.com’s Verse DEX will succeed. After that, we’ll go into the reasons for launching a DEX (ie. the advantages the Verse DEX brings to the Bitcoin.com ecosystem).

Why Verse DEX will succeed

Every other new-DEX-on-the-block must find ways to attract and retain both liquidity and users, but the Verse DEX does not have this problem.

By far the most common approach for attracting liquidity has been to give away tokens to liquidity providers. Once the liquidity is there, you have a useable product — but that’s just the first step.

Now you need users. Bots will naturally trade the pairs in your exchange, but what you really need for long-term sustainability is human users (humans are sticky). Assuming aggregators have you on their radar and your exchange is competitive in terms of fees/depth, a certain number of real users will have their orders routed through your exchange without you having to spend a dime on marketing. Of course, this only lasts as long as those sweet incentives keep flowing. Also, users who find you through aggregators may not even notice you since, in most cases, you’ll be hidden in the UX.

To make your exchange sustainable in the long run, you’ll need to find a way to keep both the liquidity and the users. The only way the liquidity will stay without the incentives is if the users are there (LPs earn a share of trading fees, which means volume must be high). So, you might try marketing; perhaps an airdrop to get your name out there? This worked for Uniswap and to a lesser extent Sushiswap, but good luck finding a spot in the sun now that those giants are already sprawled out on the beach. And by the way, the same scenario has already played out on every other L1.

It’s the users

This brings us to the single biggest advantage Bitcoin.com has: users. Millions of people self-custody their crypto using the Bitcoin.com Wallet. The vast majority of them are relative newcomers to the space, and they are itching to do something with their crypto. For example, many would like to swap between the marquee cryptos they own, adjusting their portfolio in line with the shifting trends in the crypto space. Others would like to invest in up-and-coming projects (see Verse Launchpad), pick up some NFTs, enjoy Play&Earn games, and so on. Via integrations to Bitcoin.com’s products, the Verse DEX will be at the fingertips of these people, providing essential infrastructure for their crypto/web3 journey.

Wallet owned liquidity

As for the other side of the equation, liquidity, the answer there is two fold and can be crystalized in a concept we like to call “wallet owned liquidity.”

- Bitcoin.com itself, as well as select strategic partners, will provide the initial liquidity to get the ball rolling. Bitcoin.com knows exactly what our users want to trade, which means we can focus liquidity on those pairs. Note that to provide liquidity to the Verse DEX, Bitcoin.com can use not only the VERSE tokens we receive along the Verse emissions schedule, but we can also dedicate resources from other parts of our ecosystem. This includes revenue generated from our buy and sell (with fiat) services, our news service, and our games sub brand. All of this is to say that we don’t need to offer unsustainable incentives in order to provide sufficient liquidity to the Verse DEX, neither at launch nor over the long term. Importantly, having diverse revenue sources also means the Verse DEX isn’t susceptible to the death spiral that occurs when TVL and token price fall at the same time.

- Our users will also contribute liquidity. Bitcoin.com is known for making user-friendly products. This of course extends to our Verse DEX LP dashboard which will soon be integrated into the Bitcoin.com Wallet, making it simple for even newcomers to allocate capital to the DEX and earn a share of generated fees for doing so. This also creates a nice synergy where, as users become owners of the products they use, they will not only continue to use those products, but also become advocates.

Why not just aggregate ala MetaMask?

Since MetaMask started offering swaps to its millions of users, it has managed to generate at least $200 million in revenue. This is an excellent business model, and it’s certainly something Bitcoin.com is actively exploring — but having a DEX and offering an aggregation service are not mutually exclusive. We can and will do both! Importantly, by building our own DEX, we’re able to pass on the savings to our users for the trading pairs we focus on, while routing transactions elsewhere where it makes sense to do so.

How the Verse DEX improves Bitcoin.com’s offerings

Verse is a gateway to DeFi for Bitcoin.com’s millions of users, and the Verse DEX is the foundation of that gateway. Integrating a DEX right into our mobile and desktop apps makes it easier for us to offer newcomers the opportunity to get into DeFi by putting up some collateral and earning a share of fees. As mentioned, the DEX will also be the jumping off point for everything else in DeFi including NFTs, games, and whatever else is just over the horizon in this fast-moving and innovative space. There are many ways our users can benefit from DeFi, and the Verse DEX will be critical in enabling them.

Finally, the DEX creates synergy. It does this in two ways:

First, revenue generated via the Verse DEX provides additional resources that Bitcoin.com can use to support and expand our ecosystem. It’s important to note here that fees paid on the Verse DEX do not accrue directly to Bitcoin.com. Instead, as explained in the Verse white paper, LPs will earn 0.25% of trading volume. Bitcoin.com, as a large holder of VERSE and significant liquidity provider to the Verse DEX, will simply earn its proportional share of fees as per the protocol — and those fees can be directed to supporting and expanding our ecosystem.

Second, having our own DEX means that, for projects that align with Bitcoin.com’s mission to create economic freedom in the world, we can offer a place to start trading of the associated token. Where there’s opportunity to bring additional value to our users, this will lead to partnerships and integrations with our other products.

In summary, while succeeding in the crowded DEX space is a challenge, it’s not an insurmountable one if you bring your own users to the game and have a range of liquidity sources at hand. For Bitcoin.com specifically, running our own DEX brings a range of benefits to our users while paving a wide avenue to expand our ecosystem further into the DeFi realm.