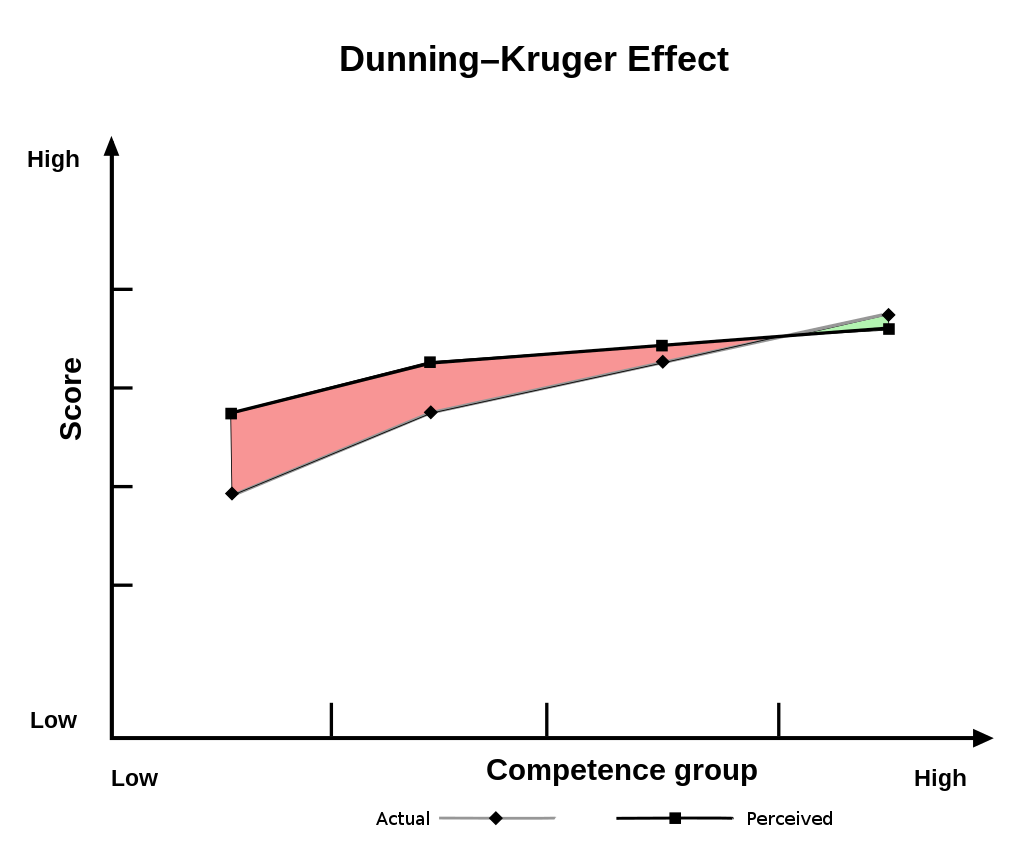

The Dunning–Kruger effect is a cognitive bias whereby people with low ability, expertise, or experience regarding a certain type of task or area of knowledge tend to overestimate their ability or knowledge. Some researchers also include the opposite effect for high performers: their tendency to underestimate their skills. In popular culture, the Dunning–Kruger effect is often misunderstood as a claim about general overconfidence of people with low intelligence instead of specific overconfidence of people unskilled at a particular task.

The Dunning–Kruger effect is usually measured by comparing self-assessment with a measure of objective performance. For example, the participants in a study may be asked to complete a quiz and then estimate how well they performed. This subjective assessment is then compared with how well they actually performed. This can happen in either relative or absolute terms, i.e., in comparison with one’s peer group as the percentage of peers outperformed or in comparison with objective standards as the number of questions answered correctly. The Dunning–Kruger effect appears in both cases, but is more pronounced in relative terms; the bottom quartile of performers tend to see themselves as being part of the top two quartiles. The initial study was published by David Dunning and Justin Kruger in 1999. It focused on logical reasoning, grammar, and social skills. Since then various other studies have been conducted across a wide range of tasks, including skills from fields such as business, politics, medicine, driving, aviation, spatial memory, examinations in school, and literacy.

Many models have been suggested to explain the Dunning-Kruger effect’s underlying causes. The original model by Dunning and Kruger holds that a lack of metacognitive abilities is responsible. This interpretation is based on the idea that poor performers have not yet acquired the ability to distinguish between good and bad performances. They tend to overrate themselves because they do not see the qualitative difference between their performances and the performances of others. This has also been termed the “dual-burden account” since the lack of skill is paired with the ignorance of this deficiency. Some researchers include the metacognitive component as part of the definition of the Dunning–Kruger effect and not just as an explanation distinct from it. Various researchers have criticized the metacognitive model and proposed alternative explanations. According to the statistical model, a statistical effect known as regression toward the mean together with the cognitive bias known as the better-than-average effect are responsible for the empirical findings. The rational model holds that overly positive prior beliefs about one’s skills are the source of false self-assessment. Another explanation claims that self-assessment is more difficult and error-prone for low performers because many of them have very similar skill levels. Another model sees lack of incentive to give accurate self-assessments as the source of error.

The Dunning–Kruger effect has been described as relevant for various practical matters, but disagreements exist about the magnitude of its influence. Inaccurate self-assessment can lead people to make bad decisions, such as choosing a career for which they are unfit or engaging in dangerous behavior. It may also inhibit the affected from addressing their shortcomings to improve themselves. In some cases, the associated overconfidence may have positive side effects, like increasing motivation and energy.