Investors generally prefer more experienced institutions and individuals to handle their investments for them. As a result, one of the biggest markets in the traditional finance world is the asset management industry. As of 2021, there are approximately $112.3 trillion in global assets under management (AUM). With global wealth at $463.6 trillion, approximately 24.2% of all wealth is managed by the global asset management industry.

By comparison, the asset management industry for decentralized finance (DeFi) is quite small. Altogether, the decentralized asset management (Yield Aggregator and Indexes) has a total value locked (TVL) of $1.3 billion. Given that the total market cap of all of crypto is ~$909 billion, only about 0.15% of all crypto wealth is managed through decentralized asset management. In other words, decentralized asset management’s share of wealth is ~161x smaller than traditional finance’s share of wealth.

Although decentralized asset management is lagging far behind its traditional finance counterpart, there is certainly an investor base that wants exposure to DeFi and its yield. That investor base was previously serviced by a plethora of CeFi companies, such as Celsius, Voyager, BlockFi, etc., that gained popularity over the 2021 bull run. Part of their popularity was due to their relatively simple and convenient interfaces. However easy-to-use these CeFi solutions were, they came with some complications in regard to their opaqueness and custodial nature.

Decentralized asset management may stand to benefit from CeFi’s failure. The recent FTX implosion has evaporated the trust of many users in centralized custodians. As such, decentralized non-custodial solutions are necessary to help regain the trust of so many that were negatively affected by FTX. In decentralized asset management, users don’t have to worry about a custodian losing their crypto. Moreover, users can verify, on-chain, the health of the products they choose to invest their money in.

Although decentralized finance’s asset management industry may be small, numerous protocols and projects are working to scale the nascent industry. Enzyme is leading the charge as the largest on-chain active asset management platform by TVL.

Background

The private company behind Enzyme, Melonport AG, was founded in July 2016 as a privately domiciled company in Switzerland. Its founders, Mona El Isa and Reto Trinkler, aimed to develop an asset management protocol on Ethereum called Melon, the predecessor name for Enzyme.

Melon V1 went live in March 2019. It allowed users to create and invest in crypto structures through the use of smart contracts. Upon the launch of Melon V1, Melonport AG wound down and handed control of the Melon protocol to the community through the Melon Council, in an effort to decentralize the project. The Melon Council was a governing body initially selected by Melonport AG prior to its dissolution.

In December 2020, Melon Protocol announced that it would be rebranding to Enzyme. The Melon Council was additionally rebranded to the Enzyme Council. On Jan. 21, 2021, Enzyme V2 introduced new smart contract architecture and enabled new features such as lending and synthetic assets. In Q1 2022, Enzyme launched the latest release, Sulu, and deployed the protocol on Polygon.

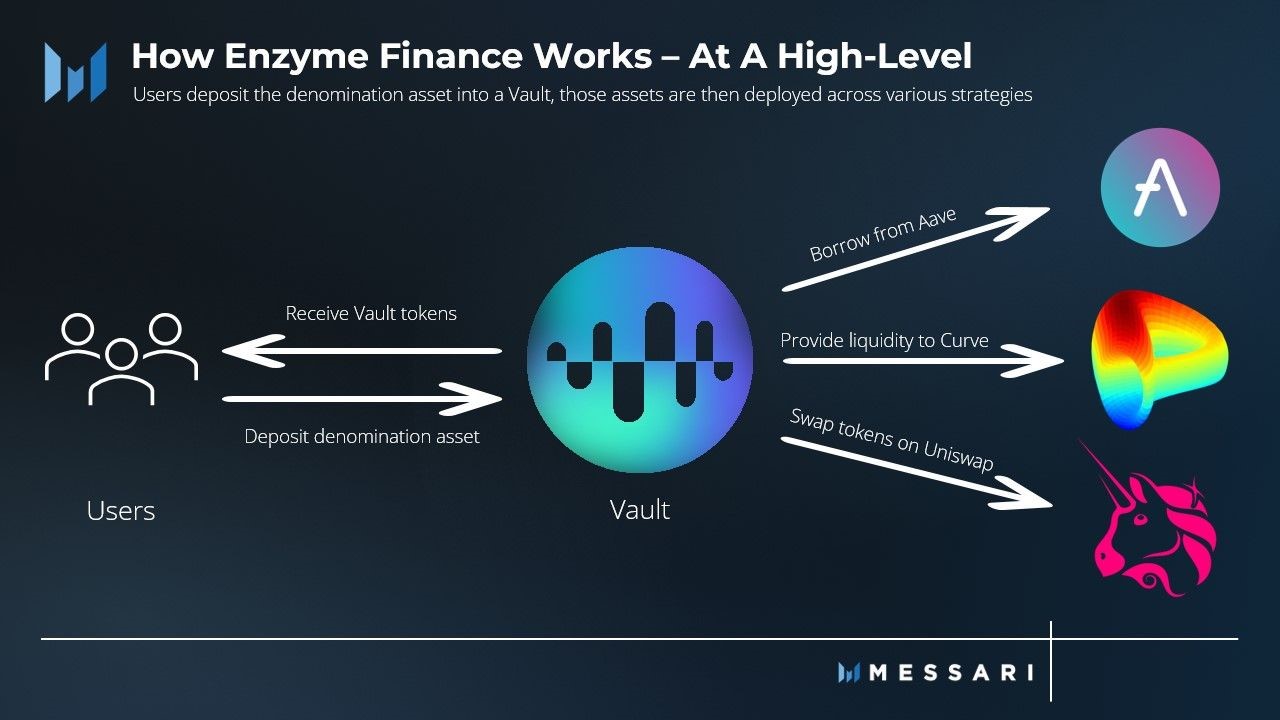

How Enzyme Works