Everything You Need To Know about Volume Profile

If you have been in the market for some time, you may have heard of a tool called “Volume Profile”. Today, we are going to take a deeper look at this tool, explain how it works, and leave you with a few tricks that you can use to supercharge your analysis.

What is Volume Profile?

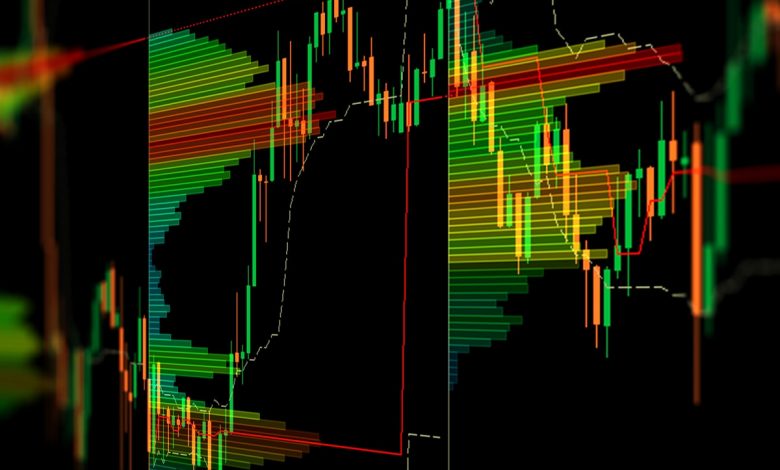

Volume Profile is an advanced charting tool that displays trading activity at specific price levels over a specified time period. On the chart, it plots a horizontal histogram to reveal areas where significant trading volume happened.

Volume Profile vs. Traditional Volume

The core difference between Traditional Volume and Volume Profile is how they consider volume with respect to the time and price.

In other words, Traditional volume tells you when volume happened, and Volume Profile tells you where it happened.

Volume Profile Terminology

The Volume Profile tool has several unique components & terminology that you should know about:

- Point of Control (POC) – The single price level in a given time period where the most volume traded.

- Profile High – The highest reached price level during the specified time period.

- Profile Low – The lowest reached price level during the specified time period.

- Value Area (VA) – The range in which a specified percentage of all volume was traded during the time period. Typically, this percentage is set to 70%.

- Value Area High (VAH) – The highest price level within the value area.

- Value Area Low (VAL) – The lowest price level within the value area.

Tips & Tricks of Volume Profile

Just like with most other tools or studies, Volume Profile has a number of uses.

One common strategy is to analyze where previous period value areas are vs. the current price. If current prices are outside of a previous period’s value area, then it can be assumed that an asset is trending. If price is still within a previous period’s value area, then some may label that asset as being in a consolidation. Determining trend and consolidation are often used in conjunction with trend following and mean reversion execution strategies, respectively.

Another common strategy is to use “Virgin” Point of Control (VPOC’s) as key levels in an asset. VPOC’s are levels that haven’t yet been retested and remain untouched by current price action since they were formed. The idea here is that if there was lots of action at a certain price, then it’s likely that the market’s biggest participants have positions from that level. This can cause predictable behavior which keen-eyed traders can take advantage of.