Exchange tokens are native assets distributed by a centralized exchange, often providing the holders’ benefits within its closed ecosystem. Initially, they were created by crypto exchanges to bootstrap funding from users and create a “community ownership” model more palatable to investors.

Exchange tokens and their use case have come under greater scrutiny due to the recent collapse of FTX. The exchange’s downfall was primarily brought about through the misuse of its native token, FTT. We explore what happened with FTT before analyzing and attempting to analyze the value of major exchange tokens.

The Curious Case of FTT

An exchange token derives its value from the health of the business of the underlying exchange. How closely the token is tied to the actual cash flows of the exchange is a broad spectrum we will example in further detail in coming sections. FTX’s exchange token FTT sat towards the end of that spectrum with a tenuous tie to intrinsic value besides faith in the FTX entity. FTT only held value if FTX existed, and therefore the token can be thought of as a bet on the solvency and health of the exchange.

FTT maintained a tie to FTX through a buyback and burn mechanism. A portion of FTX’s revenue was used to buy back and burn FTT’s supply, similar to a stock buyback. However, FTX / Alameda also used this token as collateral for loans. Instead of it being a one-way relationship where value flowed from exchange business to token, it became a circular relationship; value flowed back from the token to the exchange as the price of the token had a direct impact on the liquidity, solvency, and future of the business. As the token price came under pressure, the solvency of the business was affected, putting further pressure on the token price, and creating a death spiral.

While FTT used what seems to be a reasonable model of tying exchange value to token value by reducing token supply with profits, the exchange’s undoing was the inherent leverage it/Alameda created through using FTT as collateral. Other exchange tokens have taken different approaches to how to drive value back to the holders.

Exchange Token Value Capture

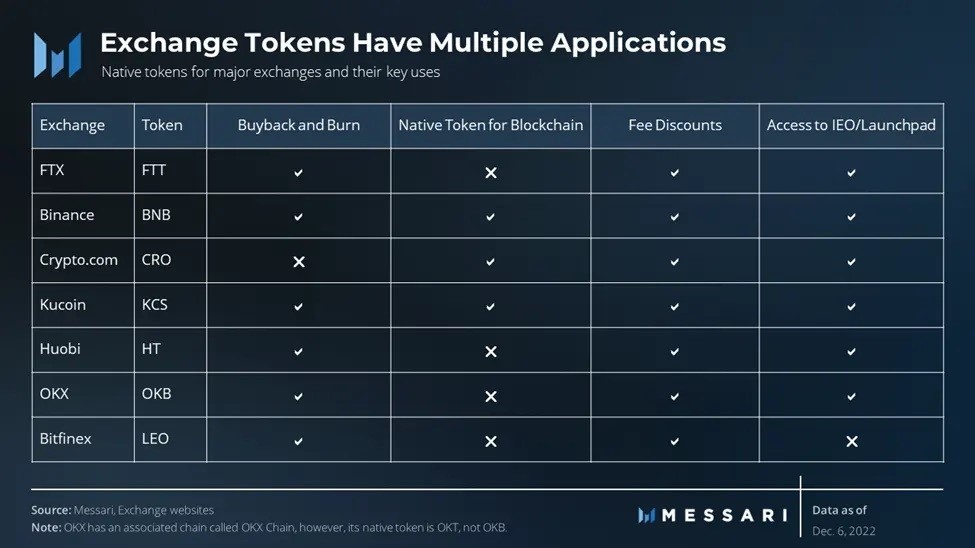

Equities can be considered a residual claim on the cash flows of the underlying company. Most native cryptocurrencies can be viewed as a claim on the revenue (transaction fees, MEV, etc.) from the blockspace of an underlying network. Within a vertical like DeFi, we can similarly think of token value as the amount of cash flow generated on the underlying network. Exchange tokens may or may not have direct ties to an exchange’s revenue but have other ways to create value for holders.