Solving The DeFi Onboarding Crisis

Can Bitcoin.com and Verse solve the DeFi onboarding crisis?

Like many in the crypto space, Bitcoin.com’s mission is to increase economic freedom for everyone. An important part of that is expanding access to financial products and services. DeFi, which enables open access to such products and services, helps create economic freedom — but in its current state, the power of DeFi is severely stunted. In this article, we’ll put forth our theory for what happened and how it can be solved. We’ll also describe what Bitcoin.com specifically is doing to make DeFi accessible to millions more people.

📢 Bitcoin.com’s VERSE token will go on sale starting Nov 1. Register now at getverse.com.

Starting blocks to stumbling blocks

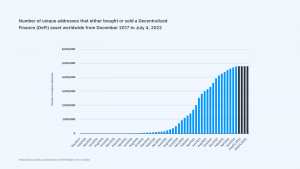

As the following chart shows, DeFi saw meteoric growth from summer 2020 (aka “DeFi Summer”) to approximately year end 2021 before stalling completely.

You might think this is purely a function of bull/bear market dynamics (after all, the stalling of growth pretty closely coincides with the move from bull to bear). However, while there’s certainly some of that at play, it’s very likely that this chart is telling us something deeper.

The reason for DeFi’s incredible growth is also the reason for its plateau. Prior to DeFi Summer, people steeped in crypto had an unfulfilled need for on-chain financial products and services. When DeFi’s usability reached an inflection point in summer 2020, crypto users with even a little bit of technological sophistication onboarded to the DeFi products available en masse. The entire cohort of users with sufficient technical prowess, but also necessarily high risk tolerance, had entered by the end of 2021.

DeFi is in a place now where there isn’t any appreciable influx of new users. This can be attributed to several factors; chief amongst them the difficult onboarding experience, unintuitive UI/UX interfaces of DeFi products, and the fact that the high risks associated with crypto in general are magnified in DeFi products. In order for DeFi to attract new users, it must overcome one or more of these problems.

Using DeFi is hard

To drive home this point, let’s take a relatively simple action: earning interest. Imagine, you’re a newcomer to the space with $5000 to deploy. It’s not a small sum of money, but if gas on Ethereum is above say 20gwei, any interest you earn will be consumed by your transaction fees, making the whole process pointless. This means you’ll need to use a low-fee chain like Avalanche, requiring you to bridge over and, if you haven’t already, set up your custom RPC for Avalanche on your wallet. Of course you’ll also need to swap into AVAX to pay for your transactions on the new chain, which means you’ll need to find a reputable DEX on Avalanche. Finally, you’ll swap into the actual assets you want to deposit into your chosen lending protocol, say AAVE.

While the above may be obvious to “crypto-natives,” newcomers would abandon the process before even starting because they wouldn’t even know where to begin. All of DeFi is like this, and it will never attract a wide audience in its current state. Ever.

Solution: a unified experience

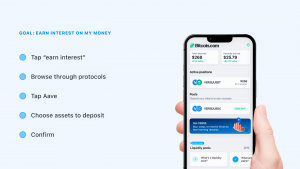

What if a user was able to navigate the above process through one wallet app where much of the complexity is hidden. The experience could be something like this:

- Click on the “earn interest” button and browse through different protocols with the range of their current rates. Select the “Aave” button because its rates seem appealing and indicated reputation is best-in-class.

- The wallet presents you with interest rates on different assets on Aave, along with relevant information such as your current holdings.

- You choose a cryptoasset like USDT. The app informs you that you don’t have this cryptoasset on this chain and asks if you would like to swap into the asset on this chain.

- You say yes and are asked what amount should be swapped? You choose a cryptoasset to swap into. A swap rate and bridge time are given. You verify and, behind the scenes, the cryptoasset you chose to swap is bridged, swapped into USDT (if necessary) and added to the appropriate Aave pool.

This is the direction DeFi needs to go, but we’re still early in that journey — and between here and there, many pitfalls await. Let’s look at the typical journey of newcomers to space to examine those pitfalls:

Bitcoin is still the gateway to DeFi

Bitcoin is the original form of decentralized finance, and it’s still the biggest gateway to what we now think of as DeFi:

- Click on the “earn interest” button and browse through different protocols with the range of their current rates. Select the “Aave” button because its rates seem appealing and indicated reputation is best-in-class.

- The wallet presents you with interest rates on different assets on Aave, along with relevant information such as your current holdings.

- You choose a cryptoasset like USDT. The app informs you that you don’t have this cryptoasset on this chain and asks if you would like to swap into the asset on this chain.

- You say yes and are asked what amount should be swapped? You choose a cryptoasset to swap into. A swap rate and bridge time are given. You verify and, behind the scenes, the cryptoasset you chose to swap is bridged, swapped into USDT (if necessary) and added to the appropriate Aave pool.

This is the direction DeFi needs to go, but we’re still early in that journey — and between here and there, many pitfalls await. Let’s look at the typical journey of newcomers to space to examine those pitfalls:

Bitcoin is still the gateway to DeFi

Bitcoin is the original form of decentralized finance, and it’s still the biggest gateway to what we now think of as DeFi:

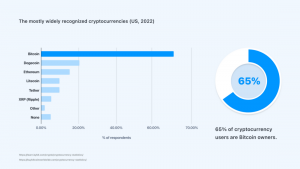

74.5% of people have heard of Bitcoin, more than 3 times as many people as the next most widely recognized cryptocurrency (DOGE). Not only that, but Bitcoin recognition is also more diverse than any other cryptocurrency. In fact, it’s the only major crypto where more women have heard of it than men (in the U.S). By comparison, 3 times as many men than women have heard of Ethereum.

Looking at ownership, despite the existence of tens of thousands of cryptocurrencies, 65% of crypto users hold Bitcoin.

So, what brings people to Bitcoin?

People are attracted to Bitcoin for many reasons — some ideological, some practical — but the majority are interested in making a profit. They hear about number go up, and they want in — and that’s fine!

Of course, when investing is your primary motivation, taking self-custody of your Bitcoin/crypto is unlikely to be highly important for you. This leads us to the first major pitfall:

The pull of centralization is strong

The majority of users don’t self-custody their assets. Actually there are more than 3 times as many users of centralized exchanges than users of self-custody wallets.

What we have here is a kind of paradox where most people who hold Bitcoin, the original form of decentralized finance, are using it in a centralized way. If your entry point to “decentralized finance” is a centralized platform, this can lead to certain…. problems.

Because DeFi is hard, entrepreneurs have tried to make it easy. That’s great. Decentralized Finance is something that shouldn’t be available to whales and techies only. Unfortunately, the latter half of the last cycle saw the rise of what can be called “Centralized DeFi” (an oxymoron if there ever was one). Here we refer to the centralized platforms that took custody of people’s assets, offering them exposure to the yields available in DeFi without any of the hassle. The UX was sweet: just send your crypto over and start earning interest. No need to move your assets between lending protocols in your chase for the highest APY. No need to rebalance your AMM pools to avoid impermanent loss. No bridging, no Discords; none of the hard parts of DeFi. Perhaps unsurprisingly, it was widely successful.

Unfortunately, it didn’t end well.

Billions of dollars were frozen and thousands of people lost their life savings on centralized platforms like Celsius and Voyager ($4.7 billion and ~$1 billion respectively).

This is not to say that “real” DeFi is devoid of dangers. In fact, the dangers are many. Just ask anyone who held UST.

Protocol risk is real

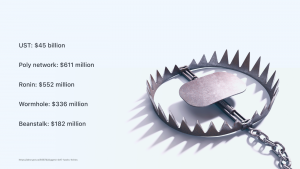

It didn’t matter whether held in custodial or self-custodial wallets, UST went to zero for the holder in both cases. $45 billion evaporated almost over night, and again, thousands lost their life savings.

Protocol risk, as it is euphemistically known, stems from a variety of factors including bugs in code, incompetent coding (the code is acting exactly as intended, but with unintended consequences), malicious actions of the developers, and so on. Protocol risk can result in hacks where just a small percentage of assets are stolen, or it may result in the total collapse of a project (with the value of its associated tokens going to zero) as was the case with UST and the Terra ecosystem.

For most public financial products, the government regulates and in many cases insures people against institutional failure. This is not the case in crypto.

Bitcoin like is was meant to be

Bitcoin.com is naturally a key entry point for newcomers to Bitcoin, and therefore for newcomers to crypto broadly. As stewards of the domain, we have a responsibility to get it right. Our mission is to create economic freedom, and we believe that self custody is critical for that.

But self custody is a paradigm shift, and it’s hard. Most people don’t even understand what it means much less realize the positive implications (like censorship resistance and elimination of 3rd-party risk) OR the consequences (like losing your funds if you lose your key).

As with all paradigm shifts, the new thing has to be way better if people are going to make the effort to change their behavior. Just like electric cars have to be just as good as, if not better than gas-powered cars, self custody has to be at least as easy as centralized custody. Acknowledging that we still have a long way to go, this is what we’re trying to do at Bitcoin.com.

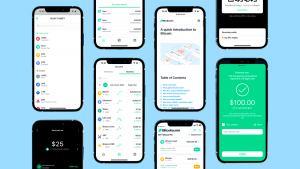

When newcomers download the self-custodial Bitcoin.com Wallet, they’re provided with educational materials on the importance of self-custody and the option to back up their private keys to the cloud. The latter eliminates the need to manage multiple seed phrases, one for each of the 3 chains we currently support.

This type of onboarding experience, we hope, sets people up for success on their crypto journey. They’ll self-custody assets from the start, gaining knowledge that is useful in the web3 world.

Bitcoin.com’s VERSE token: widening the gateway to DeFi

There’s a huge gap between getting your first crypto and safely engaging in DeFi. On that journey, UI is critical, and education is good, but incentives also have incredible power. Here’s where we think a rewards and utility token will play a big roll in onboarding newcomers to DeFi. For the Bitcoin.com ecosystem, this will take the form of VERSE, which will be rewarded to users as they progress on their journey. For example, they will be incentivized to back up their self-custody wallets securely, to learn a little more about crypto beyond Bitcoin, to make their first trade, and so on. With a gamified experience, people can be have fun on their journey to becoming DeFi natives — remembering that the goal is to empower people to have the skills and knowledge needed to take full advantage of decentralized finance and the economic freedom it creates.

We’re just getting started with Verse, but we see it as central to the Bitcoin.com ecosystem. Along with Bitcoin itself, we envision Verse to be the world’s gateway to DeFi. Learn more at getverse.com, where registrations are now open for the token sale, which goes live on November 1st.