Maximal Extractable Value – MEV

MEV - Current Landscape, Future Solutions and Key Considerations

Modern markets require intermediaries (brokers or brokerages) to aggregate and execute transactions on behalf of market participants. While blockchains decentralize the security and ownership of these intermediaries, networks still require them to execute transactions. Consequently, a blockchain’s intermediaries, in the form of security providers (miners, validators, and sequencers), become first-class citizens of the network in the same way that brokers do in traditional markets.

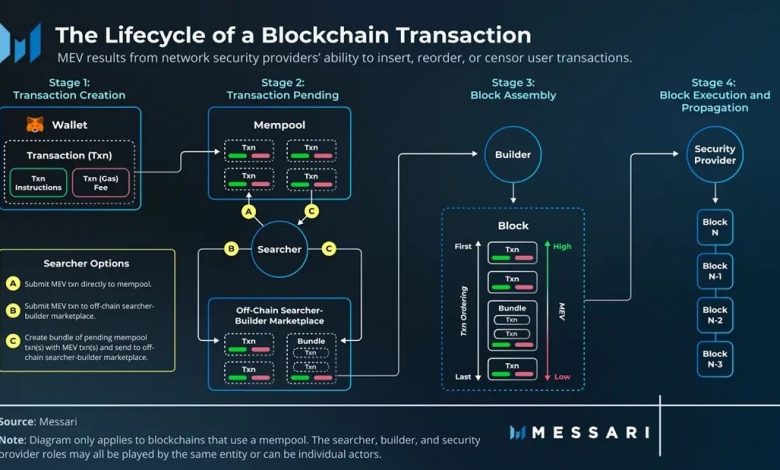

Such a power dynamic allows a blockchain’s security providers to tax users and generate additional profits during the block production process. They do so by selectively inserting, reordering, or censoring user transaction requests. This invisible, yet ubiquitous, phenomenon is what is known as Maximal (formerly Miner) Extractable Value (MEV).

Effects of MEV

MEV creates both positive and negative externalities for blockchain networks. It creates efficient markets and incentivizes proper application functionality within distributed crypto economies. However, if left uncontrolled, MEV may jeopardize network decentralization and consensus stability. Accordingly, the crypto industry is beginning to recognize the significance of MEV both as a for-profit opportunity and as an existential threat.

MEV’s emergent and abstract nature makes it difficult to define concretely. To address its intricacies, this report will provide an in-depth look at the origins of MEV before evaluating its role in the present and future state of blockchain networks.

The good

Many DeFi projects rely on economically rational actors to ensure the usefulness and stability of their protocols. For instance, DEX arbitrage ensures that users get the best, most correct prices for their tokens, and lending protocols rely on speedy liquidations when borrowers fall below collateralization ratios to ensure lenders get paid back.

Without rational searchers seeking and fixing economic inefficiencies and taking advantage of protocols’ economic incentives, DeFi protocols and dapps in general may not be as robust as they are today.

The bad

At the application layer, some forms of MEV, like sandwich trading, result in an unequivocally worse experience for users. Users who are sandwiched face increased slippage and worse execution on their trades.

At the network layer, generalized frontrunners and the gas-price auctions they often engage in (when two or more frontrunners compete for their transaction to be included in the next block by progressively raising their own transactions’ gas price) result in network congestion and high gas prices for everyone else trying to run regular transactions.

Beyond what’s happening within blocks, MEV can have deleterious effects between blocks. If the MEV available in a block significantly exceeds the standard block reward, validators may be incentivized to reorg blocks and capture the MEV for themselves, causing blockchain re-organization and consensus instability.

This possibility of blockchain re-organization has been previously explored on the Bitcoin blockchain. As Bitcoin’s block reward halves and transaction fees make up a greater and greater portion of the block reward, situations arise where it becomes economically rational for miners to give up the next block’s reward and instead remine past blocks with higher fees. With the growth of MEV, the same sort of situation could occur in Ethereum, threatening the integrity of the blockchain.

The MEV Supply Chain and Transaction Lifecycle

The pending transaction pool on a blockchain is a dark forest ripe for profit exploitation. Luckily, there are a few tools that can be used to shed light on MEV’s mysteries. The MEV supply chain is a framework recently introduced by the research organization, Flashbots. It describes the chain of actors that influence a transaction in the presence of MEV. These general classifications hold true across different blockchain networks but may serve slightly different roles depending on a network’s design choices.

Roles Within the MEV Supply Chain