During the 2021 bull market, many mining companies took advantage of rising bitcoin prices by raising capital through the issuance of new equity and debt in order to grow their operations. Public mining stocks exploded upwards alongside Bitcoin. However, the broader macro environment caused the euphoria to come to an abrupt halt in 2022. Hashrate at an all-time high combined with increasing energy prices and bitcoin trading near its cycle low have put miners in an increasingly difficult position. Many public miners have resorted to selling bitcoin to continue financing their operations and to service their debts.

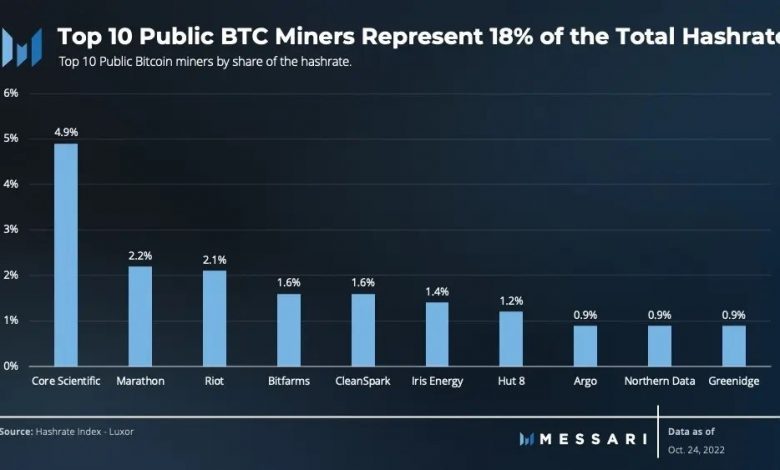

What’s different this cycle compared to last cycle is the increased participation of public companies in the mining industry. The Hashrate Index reported that in October 2021, public miners represented 11% of the total hashrate. One year later, public miners’ share of the total hashrate has increased to 33%. In the event that some of these companies end up going bankrupt due to being mismanaged, they will have to sell the bitcoin on their balance sheet, adding downward pressure to the trading price.